If you’re craving a cozy, flavor-packed dinner that won’t leave you with a sink full of dishes, this Pepperoncini Chicken Skillet is about to become a weeknight favorite ✨ Tender, golden-seared chicken simmers in a creamy, tangy sauce made with pepperoncini peppers, garlic, Italian seasoning, and just a touch of heat for the perfect balance of comfort and bold flavor.

This easy one-pan recipe is perfect for busy weeknights, chilly February evenings ❄️, or anytime you want a satisfying meal without a lot of fuss. Serve it over pasta or rice to soak up every bit of that rich, creamy skillet sauce 🍝🍚.

Simple ingredients. Big flavor. Minimal cleanup. 🙌

Exactly the kind of meal that brings everyone to the table.

And don’t forget — every week I share a new Angie’s Thursday Tasty Recipe, so be sure to check back for more cozy family favorites 💛

Planning to sell this spring? While you may be tempted to hold off until the first blooms or the spring showers hit, that’s actually waiting too long to get started by today’s standards.

Buyers have more options than they did a few years ago. So, it’s worth it to tackle repairs now and make sure your house is set up to stand out. Because you don’t want to be caught scrambling right before the spring rush. Or, running out of time to do the work your house really needs.

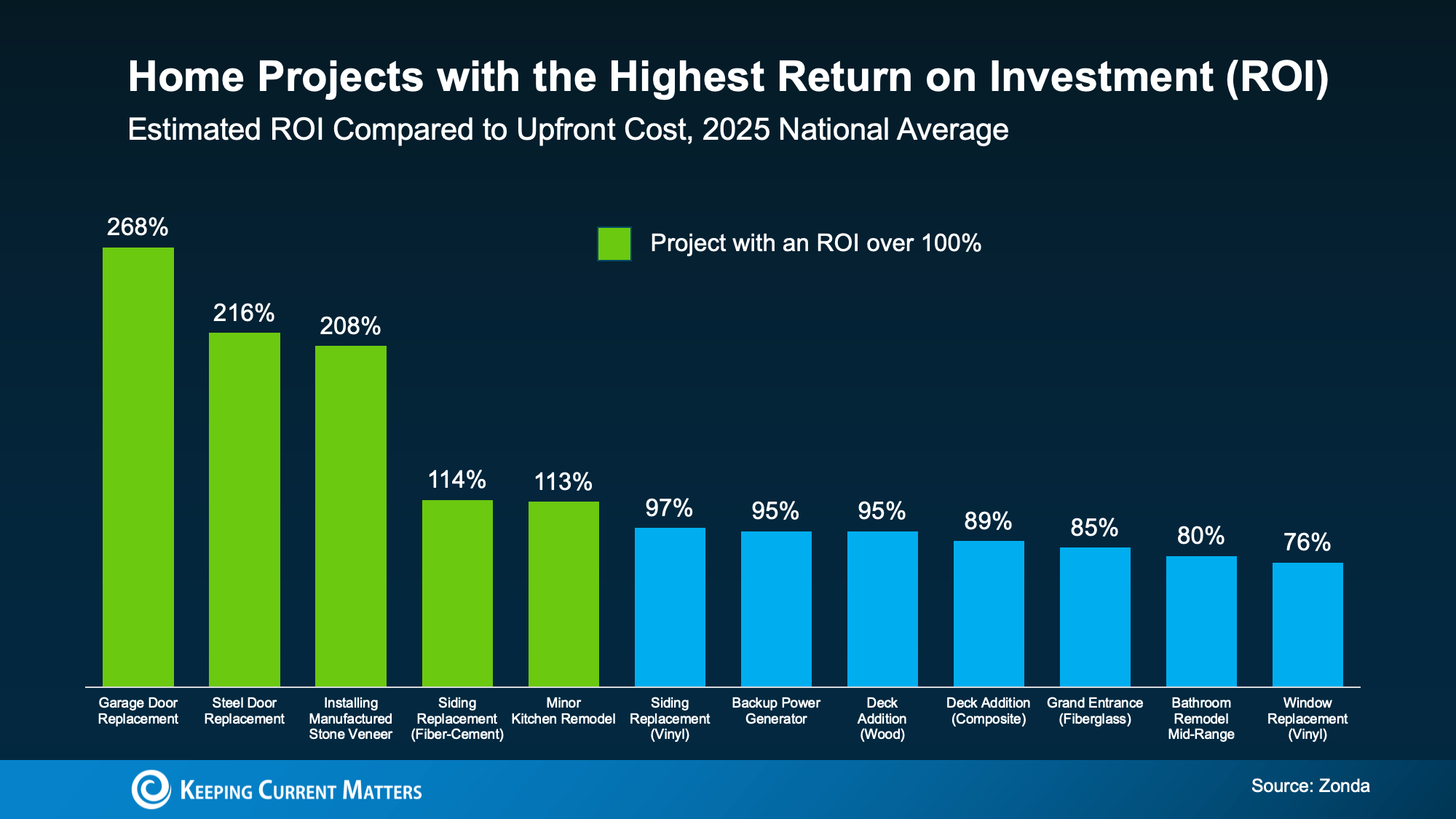

The key is focusing on updates that actually matter. And that’s exactly where return-on-investment (ROI) data comes in handy.

Which Projects Tend to Pay Off?

Every year, Zonda looks at which home improvements deliver the most bang for the buck when you go to sell the home. And the results can be a little surprising.

The green in the chart below shows the updates where sellers have the biggest potential to add value based on that research:

While there’s a wide range of projects represented in this data, the cool part is, some of the top winners aren’t big to-do’s. They’re just swapping out doors.

While there’s a wide range of projects represented in this data, the cool part is, some of the top winners aren’t big to-do’s. They’re just swapping out doors.

Small Updates, Big Visual Impact

This goes to show little projects can have a big impact. So, you don’t have to spend a fortune. And you don’t need to tackle everything on this list. But in today’s market, doing nothing can work against you.

Now that buyers have more homes to choose from, a lot of them are going to opt for what’s move-in ready.

The best advice? Focus on what your house needs, whether it’s listed here or not – like the repairs you’ve been putting off. A front door or shutters in need of a little TLC. Piles of leaves in the yard. Scuffed up paint where your kids play inside. Those details matter too.

Mallory Slesser, Interior designer and Home Stager, explains it to the National Association of Realtors (NAR) this way:

“If you’re looking for affordable updates that pack a punch, dollar for dollar, I would say painting; changing out light fixtures; changing out hardware; maybe new draperies or window treatments. Those are all cost-effective ways to make a big statement. It really changes the space.”

These seemingly small things help buyers focus on the home itself – not the work they think they’ll have to do after moving in. And that’s paying off for other sellers. Buyers are often willing to spend more on homes that feel well cared for, updated, and move-in ready.

This Chart Is a Starting Point, Not a Strategy

Here’s the important thing to remember. National data like this is a guideline. Buyer preferences are going to vary by location, price point, and even neighborhood. That means a project that boosts value in one area might be unnecessary (or even overkill) in yours.

That’s why the first step should always be to talk with a local real estate professional before you start.

An experienced agent can help you answer questions like:

- Which updates do buyers in your market expect?

- What can you skip without hurting your sale?

- Where will a small investment make the biggest difference?

- Is it better to update, or sell as-is?

That guidance helps you avoid over-improving and under-preparing.

Bottom Line

If you’re looking to sell this spring, you still have time to make updates that help your home stand out – without taking on a full renovation.

If you’re not sure where to start, talk to a local about what makes sense for your house. A quick conversation can help you prioritize the updates that’ll pack the biggest punch.

What’s one upgrade you’ve been thinking about – and wondering if it’s worth it?

If you’re craving a cozy, comforting meal with a fresh burst of flavor, this Lemon Chicken Orzo Skillet is about to become a staple in your kitchen. Juicy lemon-seared chicken, tender orzo pasta, vibrant spinach, and tangy feta all come together in one skillet making cleanup a breeze and dinner extra satisfying.

This recipe is perfect for busy weeknights, casual family dinners, or anytime you want something warm and nourishing without spending hours in the kitchen. Bright lemon and savory chicken create a balanced dish that feels both comforting and light—especially welcome during the winter months.

Whether you’re cooking for your family or hosting friends, this one-pan meal is sure to impress with minimal effort.

If you’re planning to buy a home this year, you may be focused on the spring market. And hoping that when spring does hit, you’ll see:

- Mortgage rates drop a little more.

- More homes hit the market.

But here’s what most buyers don’t realize. Buying just a few weeks earlier could mean paying less, dealing with less stress, and feeling less rushed.

Here are three reasons why accelerating your timeline over the next few weeks could actually be a better play.

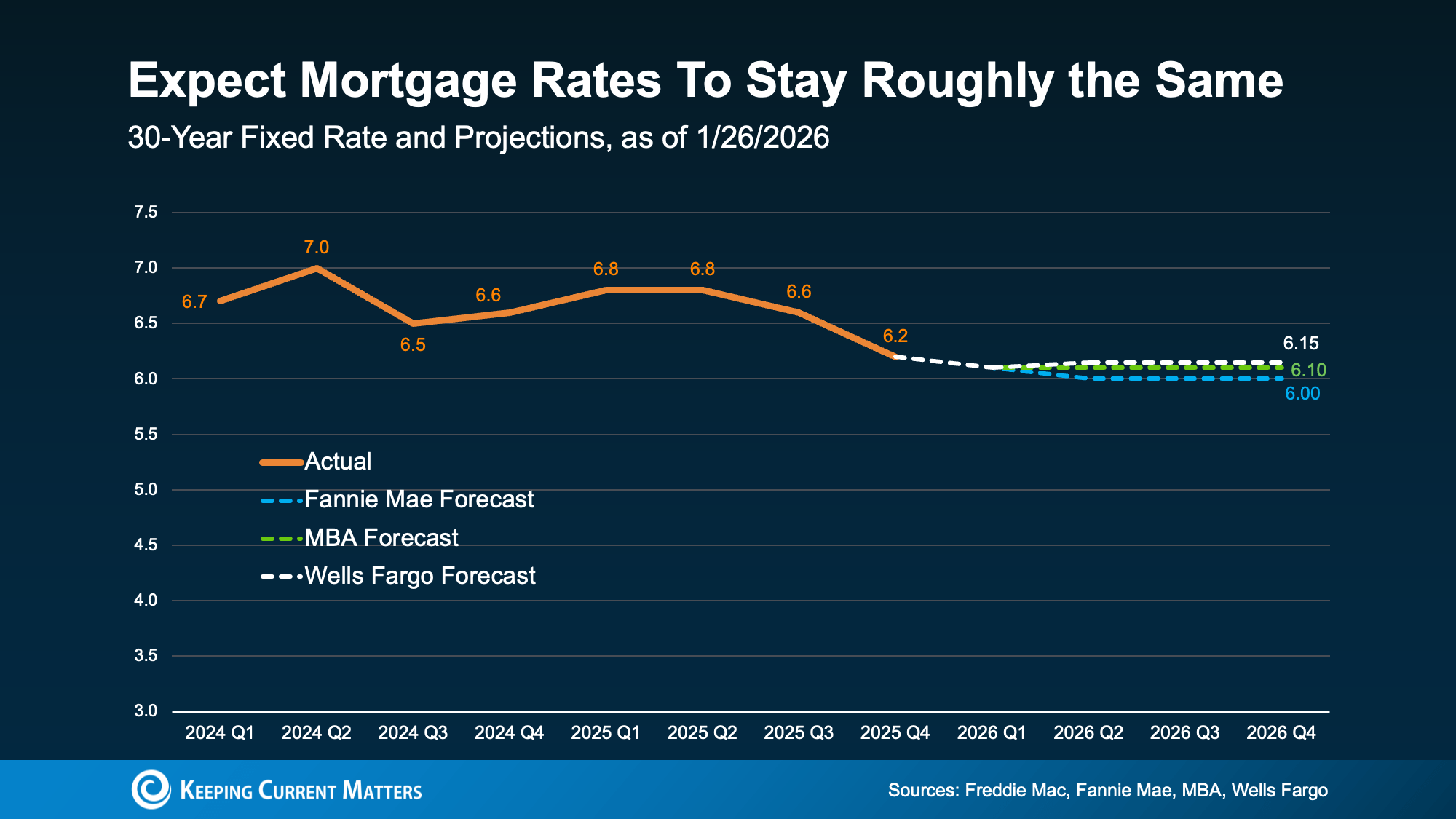

1. Holding Out for Lower Rates May Not Pay Off

A lot of buyers are hoping mortgage rates will fall even further. But that’s not the best strategy. Here’s why. Experts are pretty aligned on this: rates are expected to stay roughly where they are.

Forecasts throughout the industry all point to the same thing: rates are projected to be in the low-6% range this year (see graph below):

That’s not a bad thing, especially if you consider how much rates have already come down. Over the past 12 months, they’ve dropped roughly a full percentage point. And for many buyers, that means affordability has already improved more than they may realize.

That’s not a bad thing, especially if you consider how much rates have already come down. Over the past 12 months, they’ve dropped roughly a full percentage point. And for many buyers, that means affordability has already improved more than they may realize.

So why wait a few more weeks just for more buyers to jump in and act as your competition? You already have a window right now. As Chen Zhao, Head of Economics Research at Redfin, explains:

“House hunters should know that this may be near the lowest mortgage rates fall for the foreseeable future.”

2. Spring Means More Competition + More Stress

Speaking of competition, the spring market is popular for a reason, but with popularity comes pressure. With more buyers active at that time of year, you’ll have to move faster once you find a home you like. And no one likes feeling rushed.

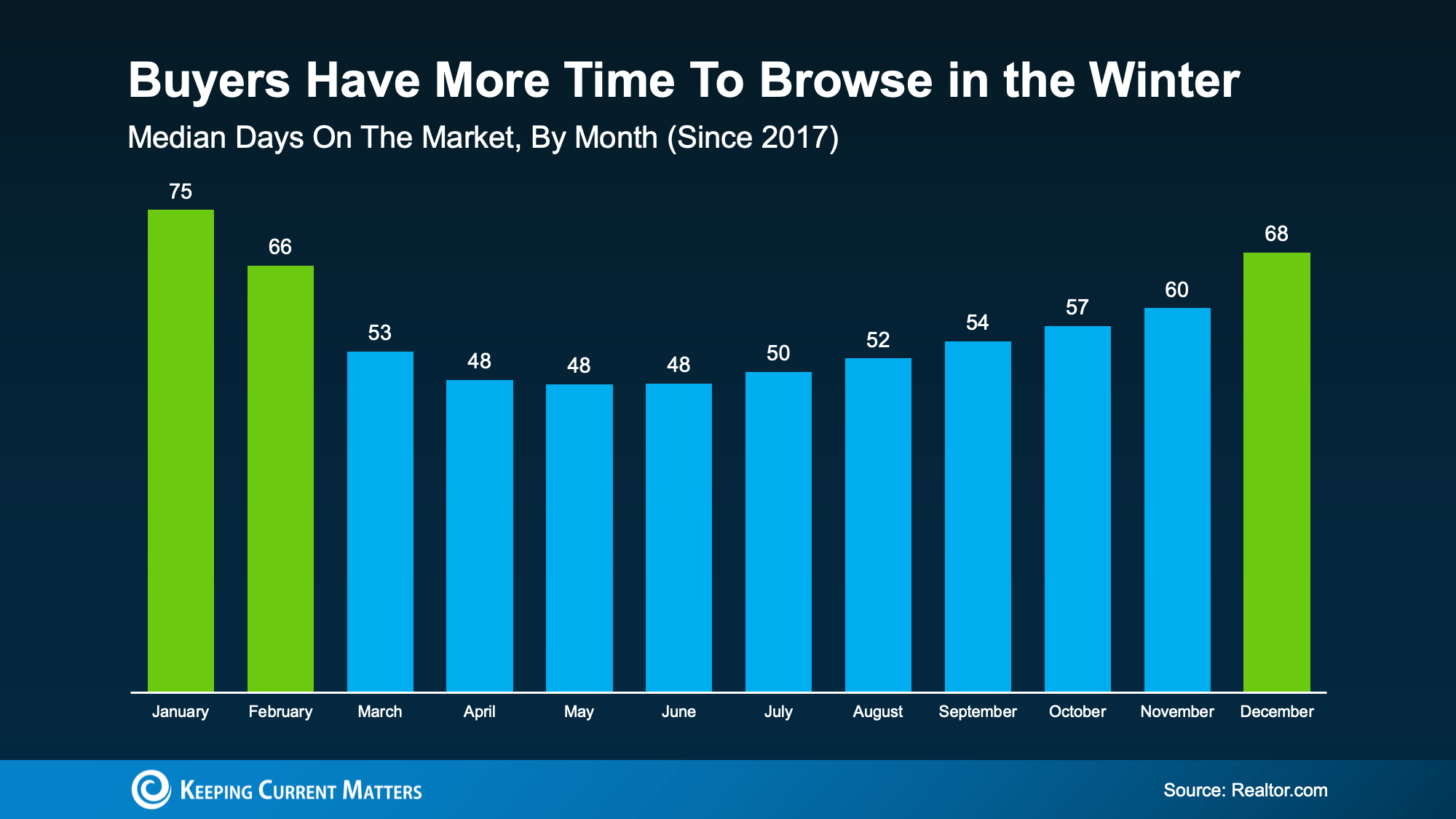

But buy now and you have more time to browse. Fewer people are looking, so homes sit longer.

You can see this play out in the data from Realtor.com (see graph below). In winter months, it takes an average of about 70 days for a home to sell. In spring? That drops to about 50 days. That’s a 20-day swing – and that pace is going to be more stressful.

Homes sell faster in the spring, and slower in the winter. And that can be a worthwhile perk for buyers who want to get ahead before their decisions start to feel rushed.

Homes sell faster in the spring, and slower in the winter. And that can be a worthwhile perk for buyers who want to get ahead before their decisions start to feel rushed.

3. Prices Tend To Rise When Competition Heats Up

And here’s something most buyers forget to factor in. Prices usually respond to demand. So, when demand is higher, prices are too. Bankrate explains:

“Spring and early summer are the busiest and most competitive time of year for the real estate market . . . home prices tend to be steeper to reflect the increased demand.”

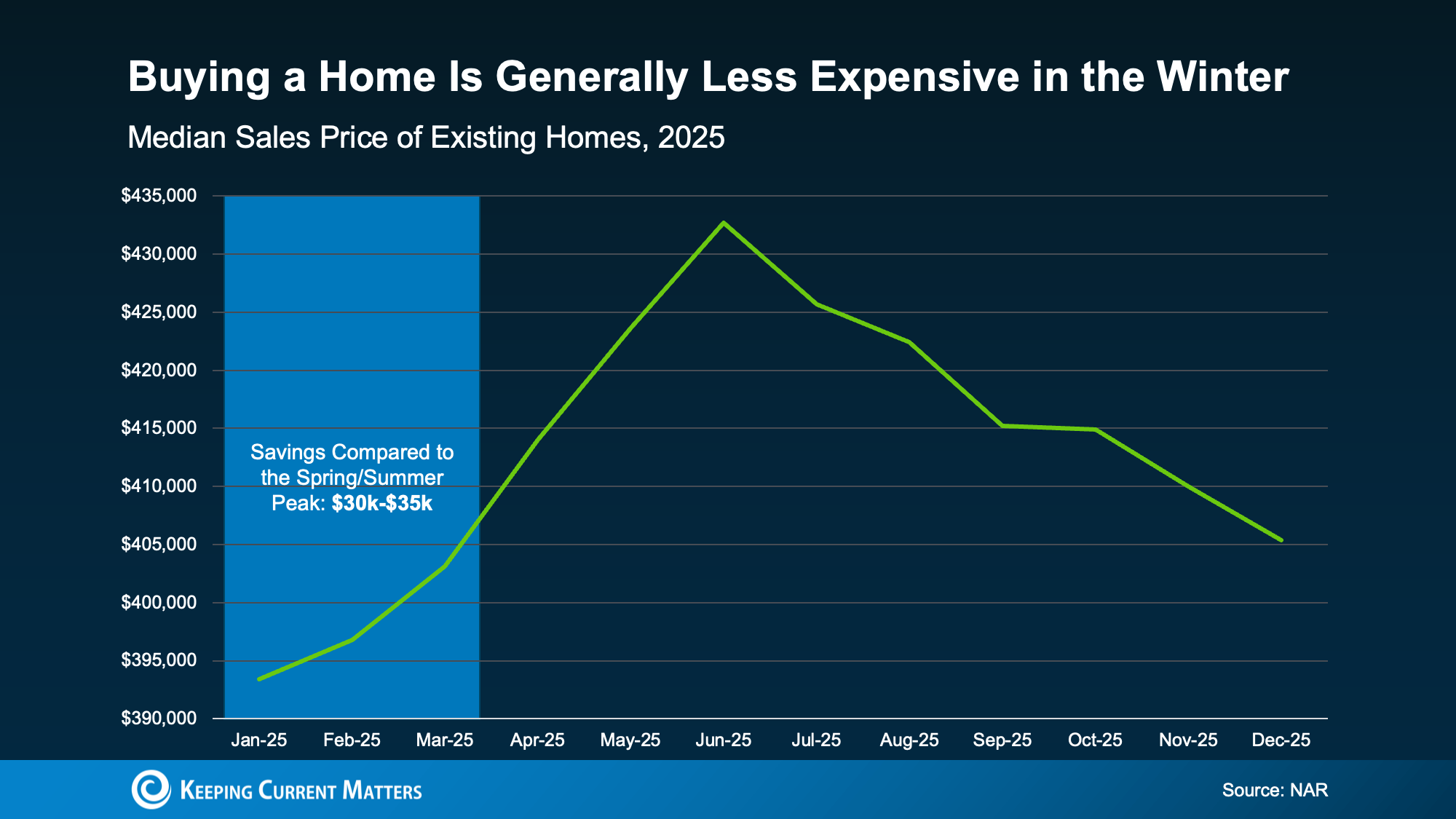

In fact, data from the National Association of Realtors (NAR) shows that in 2025, buyers who purchased in the beginning of the year saved roughly $30,000–$35,000 compared to those who bought when prices peaked in the spring or early summer.

And let’s be honest, for a lot of buyers today, every little bit of savings helps. That’s why buying just a few weeks earlier, before prices ramp up, will be better for you and your wallet.

And let’s be honest, for a lot of buyers today, every little bit of savings helps. That’s why buying just a few weeks earlier, before prices ramp up, will be better for you and your wallet.

Bottom Line

Buying a few weeks before spring isn’t about rushing. It’s about choosing to be ahead of the curve and knowing you want more leverage, less stress, and meaningful savings.

If you’re ready and able to buy now and want to get the ball rolling, connect with us today.

Stuffed Bell Pepper Casserole is the perfect comfort-food dinner when you want something hearty, flavorful, and easy to make! 🌶️🧀🥘

It has all the delicious goodness of traditional stuffed peppers—seasoned ground beef, colorful bell peppers, rice, Rotel, and tomato sauce baked together in one cozy casserole dish. No stuffing required, no fuss… just mix, bake, and enjoy! 🙌✨

This recipe is a great option for busy weeknights, meal prepping, or feeding a hungry crowd. Plus, it’s super customizable swap the beef for turkey, spice it up with extra Cajun seasoning, or add more cheese (because more cheese is always a good idea 😍🧀).

Top it off with fresh cilantro and a dollop of sour cream for the perfect finishing touch!

If you try this recipe, I’d LOVE to hear what you think, leave a comment and tell me your favorite casserole add-on! 💛

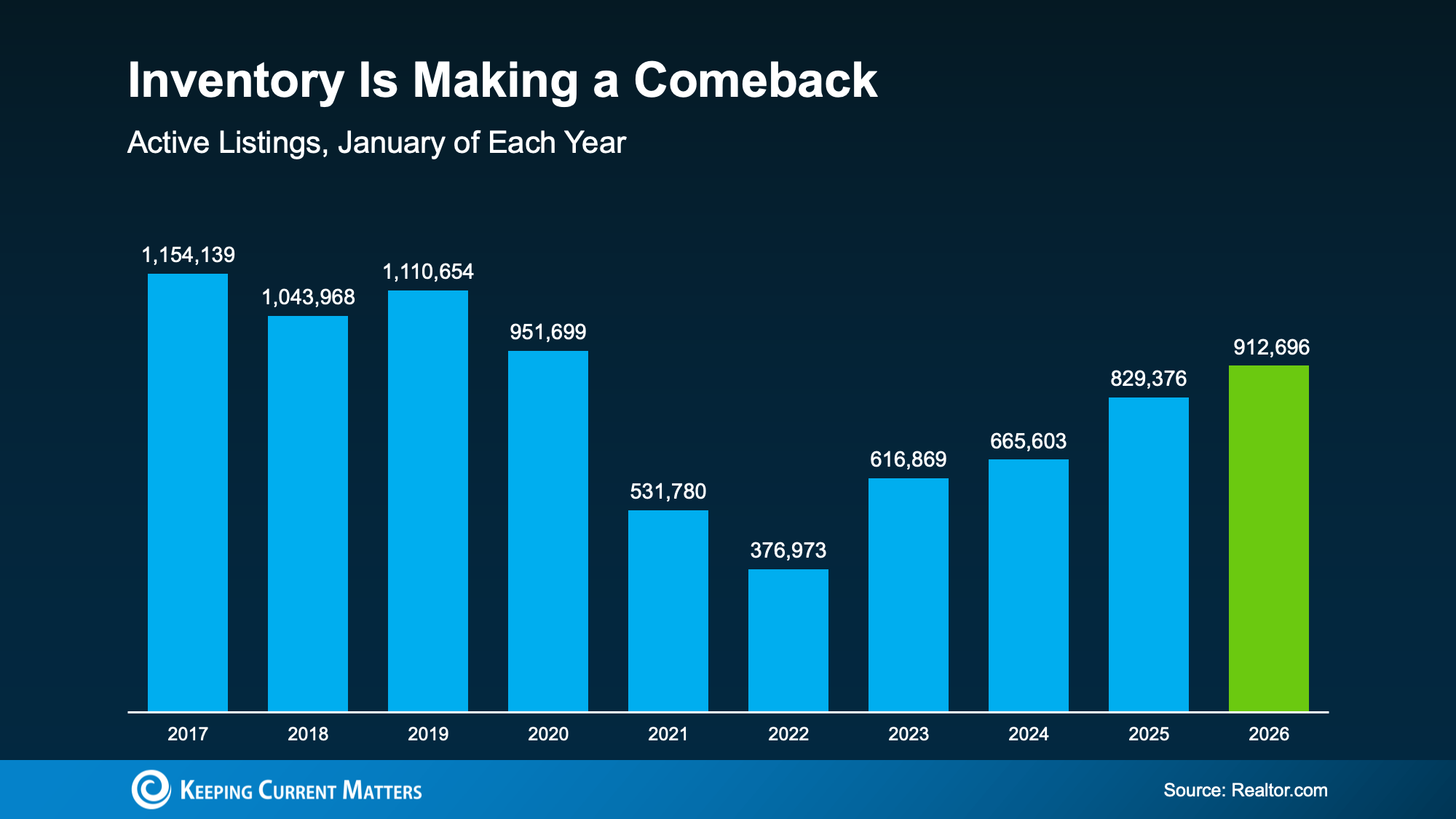

After a long stretch where buyers were competing for too few homes, inventory has made a comeback over the past year. And depending on where you live, that’s opening up your options in a meaningful way.

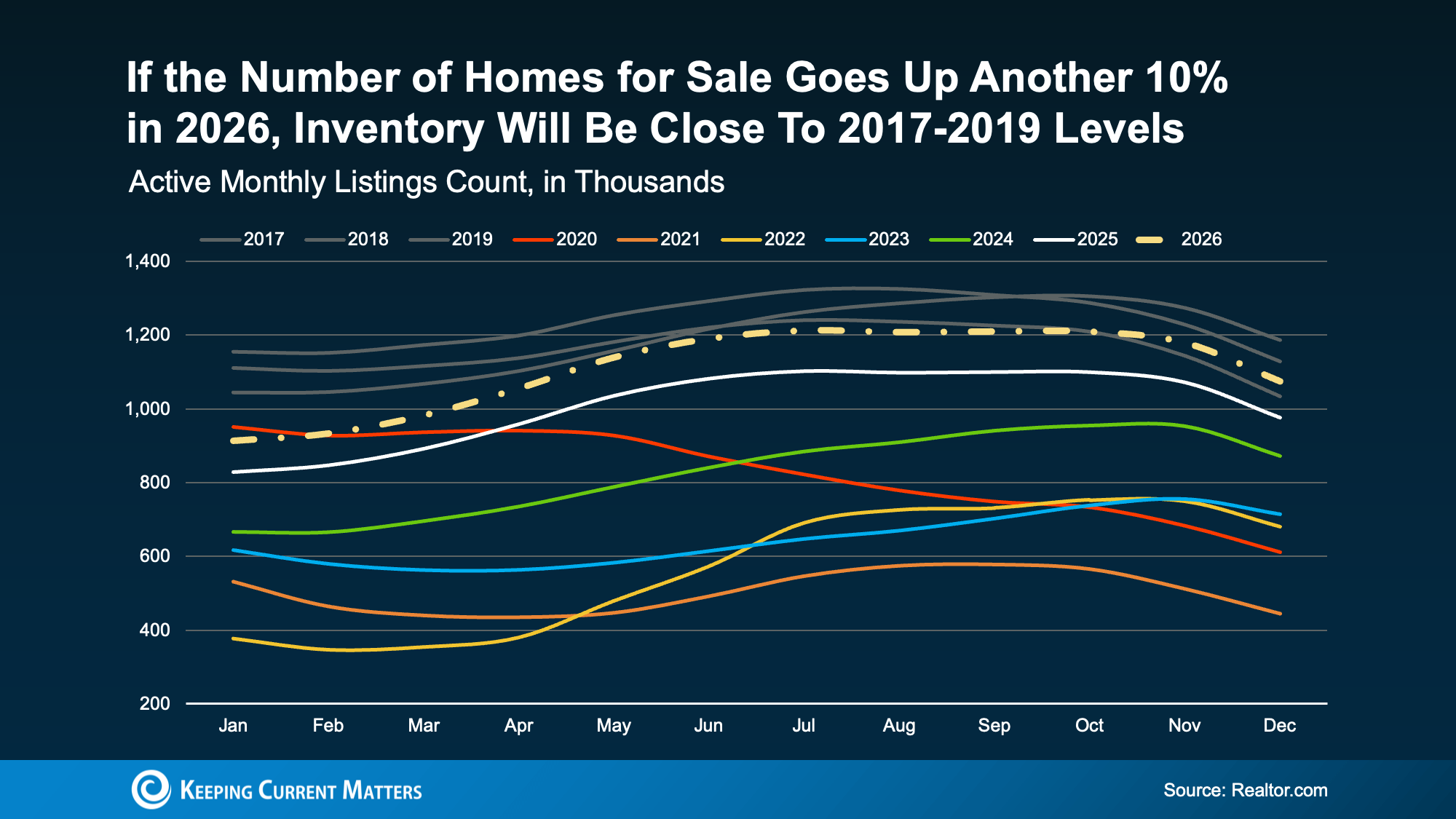

According to Realtor.com, the number of homes available for sale in January was the highest it’s been since 2020. Here’s why that’s such a big deal. Getting back to pre-pandemic levels signals a slow and steady return to what’s typical:

Now, it’s worth noting, nationally we’re not there yet and having more inventory improving won’t suddenly “fix” the market. But the growth we’ve seen lately still changes how competitive the market feels.

Now, it’s worth noting, nationally we’re not there yet and having more inventory improving won’t suddenly “fix” the market. But the growth we’ve seen lately still changes how competitive the market feels.

- When there are more homes for sale, buyers gain time, options, and leverage.

- When there aren’t, the pressure ramps up quickly.

In the years since 2020, there weren’t enough homes for sale, and that made the market feel different. Rushed. Stressful. Intimidating.

But now it’s finally getting better.

A Growing Portion of the Country Is Getting Back to Normal

Depending on where you live, inventory growth is going to vary. Some places are bouncing back faster than others. According to Lance Lambert, Co-Founder of ResiClub, in January 2025, just a little over one year ago, only 41 of the 200 largest metros were back to normal inventory-wise.

But around the end of year, almost half (90) of the largest 200 metro areas were back at or above typical levels. That’s a big improvement in roughly a year. And it’s not done yet.

Inventory Is Expected To Keep Growing

Looking ahead, forecasts suggest the number of homes for sale could rise another 10% this year, which means even more markets should join the list of places where supply has rebounded.

Here’s a graph that shows what an extra 10% would do for the market this year. You can see that projected growth (shown in the dotted line) hits inventory levels seen in 2017-2019 by roughly this fall (the gray lines). That means we may reach normal by end of year, nationally:

And that changes your home search in a good way. As Hannah Jones, Senior Economic Research Analyst at Realtor.com, puts it:

“. . . housing market conditions are gradually rebalancing after several years of extreme seller advantage. Buyers are beginning to see more options and modest negotiating power as inventory improves . . .”

In other words, the market is starting to work with buyers again — not against them.

Bottom Line

Inventory isn’t fully back to normal everywhere. But it’s moving in the right direction. And, in some areas, it’s already there.

If you’ve been waiting for a moment when you have options and a little breathing room, this is the strongest setup buyers have seen in a long time.

There’s something extra special about comfort food made from scratch — especially when it’s served in fresh baked sourdough bread bowls. 🍞✨

This week’s Angie’s Thursday Tasty Recipe is a rich, creamy Loaded Potato Soup, topped with crispy bacon, melted cheddar, and green onions, then ladled into warm homemade sourdough bowls. Cozy, hearty, and perfect for chilly days, this recipe is guaranteed to bring everyone back for seconds.

Whether you’re warming up after a long day or gathering around the table with family, this soup is comfort food at its finest — simple ingredients, big flavor, and lots of love.

From our kitchen to yours, enjoy every bite. 🏡💛

Debbie & Angie

Let Our Family Bring Your Family Home

Winter Home Maintenance Tips: Protect Your Home This Season

Winter weather can be tough on your home, but a little preparation now can help you avoid costly repairs later. Cold temperatures, storms, and increased energy use can all take a toll if your home isn’t ready. The good news? A few simple maintenance steps can keep your home warm, safe, and running efficiently all winter long.

Simple Ways to Get Your Home Winter-Ready

Seal Drafts

Check windows and doors for drafts and add weatherstripping where needed. Sealing gaps keeps cold air out, warm air in, and helps lower heating costs.

Service Your Furnace

Schedule a furnace check-up and replace filters regularly. A well-maintained heating system runs more efficiently and keeps your home comfortable throughout the season.

Protect Your Pipes

Insulate exposed pipes and, during extreme cold, allow faucets to drip slightly. This small step can help prevent frozen or burst pipes.

Inspect Roofs and Gutters

Clear debris from gutters and look for loose or damaged shingles. This helps prevent ice dams and water damage during winter storms.

Test Smoke and Carbon Monoxide Detectors

Replace batteries and test all detectors to make sure your home is protected—especially important when heating systems and fireplaces are in use.

Reverse Ceiling Fans

Set ceiling fans to rotate clockwise during winter. This pushes warm air back down into the room, helping maintain a consistent temperature.

Prepare for Power Outages

Keep flashlights, extra batteries, and bottled water on hand in case winter storms cause power disruptions.

Clean and Inspect Chimneys

If you use a fireplace, have your chimney inspected and cleaned to reduce fire risks and ensure safe operation.

A Little Preparation Goes a Long Way

Staying on top of winter home maintenance not only protects your investment—it also improves comfort, efficiency, and peace of mind throughout the season.

If you need recommendations for trusted local professionals to help with any of these tasks, we’re always happy to share our go-to resources.

"Let Our Family Bring Your Family Home"

Debbie & Angie

#WeBringUHome

❄️ There’s nothing better than starting the new year with something warm, comforting, and made with love.

This week’s Angie’s Thursday Tasty Recipe is a cozy favorite Creamy Chicken & Wild Rice Soup. It’s rich, hearty, and perfect for chilly January days when you want your kitchen to feel like home.

This recipe is easy to make, filled with wholesome ingredients, and guaranteed to warm you from the inside out. Pair it with crusty bread, gather the family, and enjoy one of those simple moments that make a house feel like home. 🏡💛

From our family to yours ~ happy cooking and happy New Year!

Debbie & Angie

"Let Our Family Bring Your Family Home"

The Share of Homeowners Selling with an Agent Just Hit a New All-Time High

91% of homeowners use an agent when they sell. That’s a new all-time high. That’s because this market rewards the right strategy. Let’s talk to make sure you’ve got it.

Sources Used for data:

https://www.nar.realtor/research-and-statistics/research-reports/highlights-from-the-profile-of-home-buyers-and-sellers